Analyst44 • Market Intelligence

How Earnings News

Moves Markets

Earnings headlines move markets—but not always in obvious ways. This post explains how reported results, guidance changes, and unexpected details translate into real price action, using real-time scoring and structured analysis from Analyst44 to separate signal from noise.

How to Trade Around Earnings Season

Earnings season is one of the most volatile and opportunity-rich periods in the market. Prices often move sharply not because of the reported numbers alone, but due to how results compare to expectations and what they imply about the future.

What actually moves stocks during earnings:

- Revenue growth trends versus prior quarters

- Margins and cost structure stability

- Forward guidance and management confidence

- Market positioning before the announcement

A common mistake traders make is focusing only on whether earnings beat or missed consensus. In reality, markets react to the earnings delta — the change relative to previous performance, expectations, and implied growth assumptions.

Key trading approaches around earnings season:

- Pre-earnings positioning based on trend, volatility, and expectations

- Post-earnings reaction trades after volatility compresses

- Avoiding binary risk when uncertainty is extreme

- Separating signal from noise in headlines

Stocks showing consistent revenue growth and stable margins tend to exhibit more predictable post-earnings behavior. By contrast, companies relying on aggressive guidance or accounting adjustments often experience erratic price action and elevated risk.

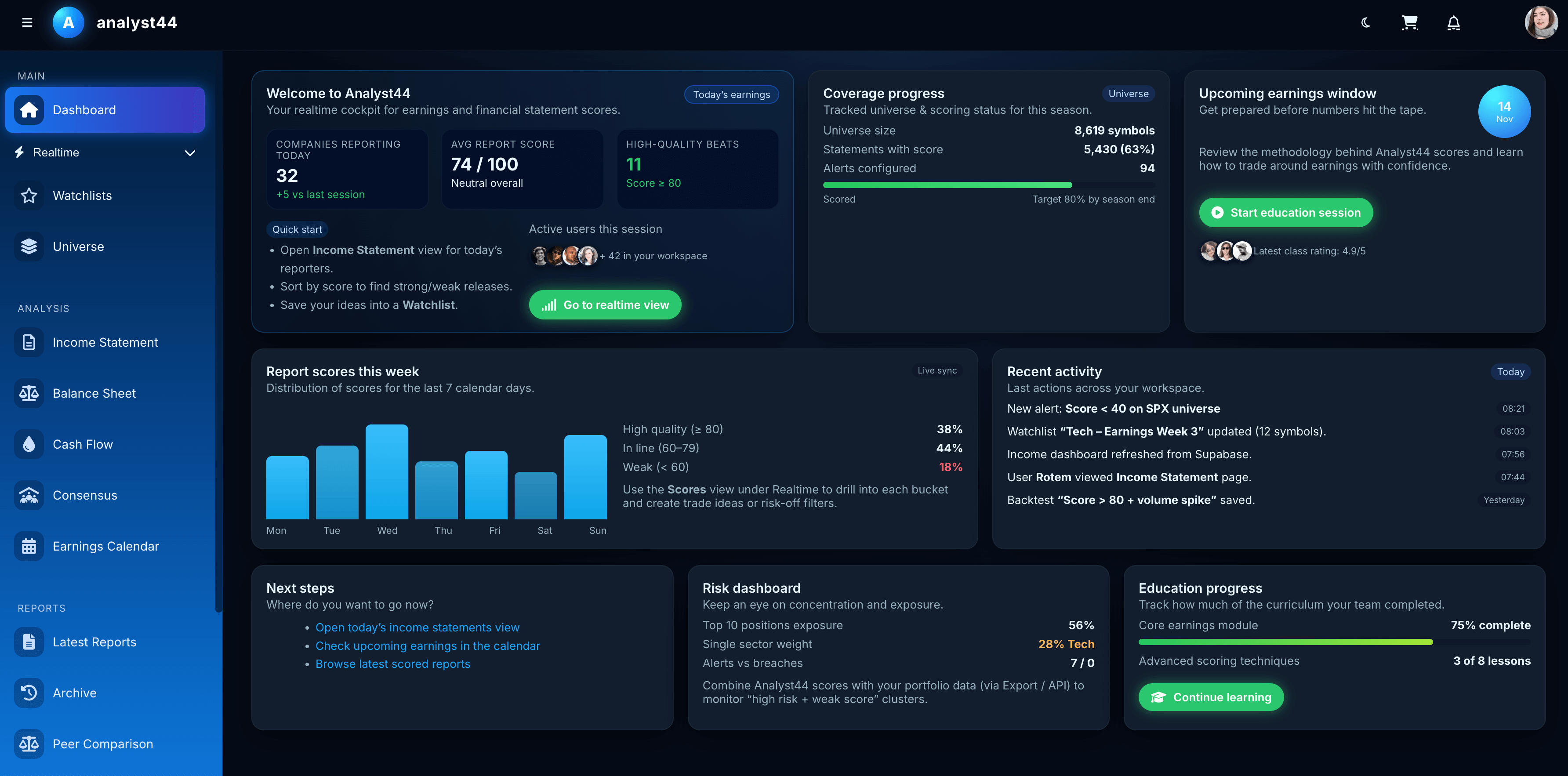

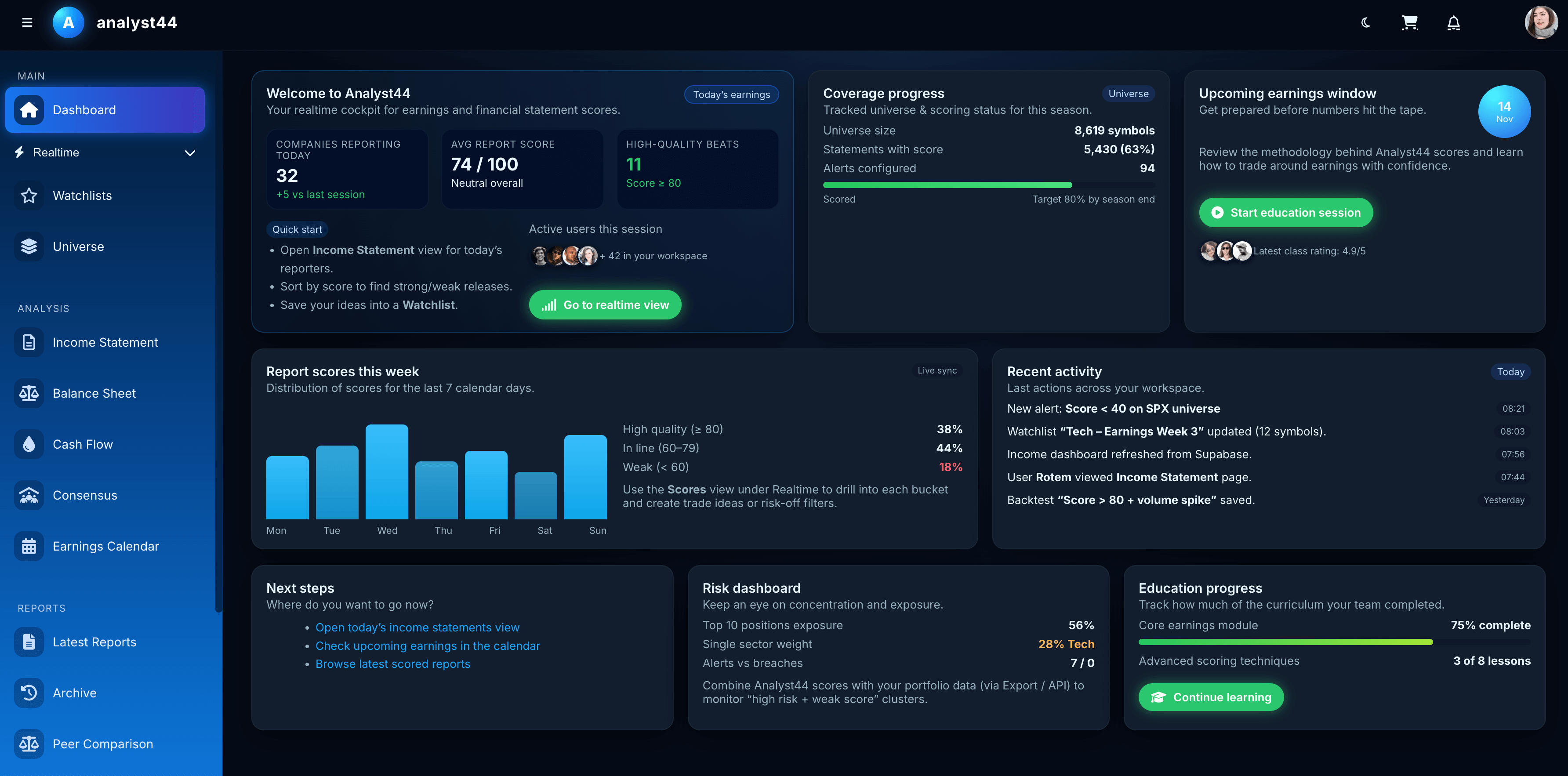

How Analyst44 supports earnings trading:

- Normalized analysis of financial statements

- Realtime interpretation of earnings headlines and guidance

- Detection of one-time items and distortions

- Comparison against historical earnings baselines

Trading earnings successfully is less about predicting surprises and more about understanding how new information changes risk, valuation, and direction. A structured, data-driven approach allows traders to stay disciplined and focus only on situations where earnings truly matter.

Requirements

- This application is designed for users with basic familiarity with financial markets and earnings-related terminology.

-

To use the platform effectively, the following background is recommended:

- Basic understanding of stocks, earnings, and market behavior

- Ability to read financial headlines and interpret simple metrics

- Comfortable working with web-based dashboards and charts

- Stable internet connection for realtime data updates

- Interest in earnings analysis, financial statements, and market-driven insights

- While the system is intuitive, it is not intended as an introduction to investing. Users without prior market exposure may require additional learning resources.

Trainer

Analyst44 Team

Professional Market Analysts & Trading Educators

The Analyst44 team consists of experienced market analysts and traders specializing in earnings-driven price action, financial statements interpretation, and systematic trade decision frameworks. This app is built on real market data, live case studies, and years of professional trading experience.